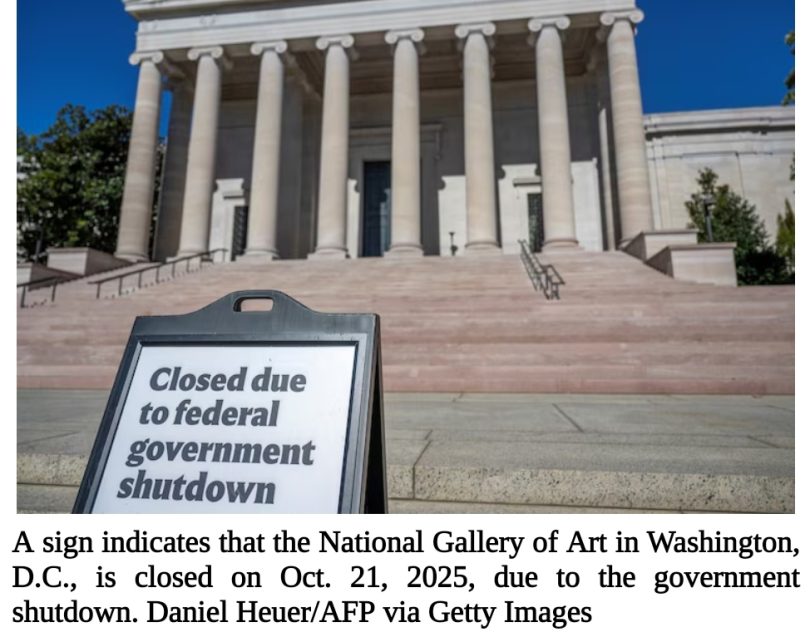

In the autumn of 2025, the United States confronted the longest federal government shutdown in its history. Beginning on October 1 and lasting 43 days, the impasse exposed serious vulnerabilities in the nation’s budget process, deep partisan divisions, and real hardship for millions of Americans. The shutdown was finally brought to an end in mid-November when Congress approved emergency funding to reopen federal operations through January 2026 after record lost economic output and mounting public frustration.

This article examines who was seen as responsible for the shutdown, what the American public thought, and how people, especially those already struggling, were materially affected.

The Political Deadlock That Triggered a Shutdown.

A government shutdown occurs when Congress fails to enact appropriations or a short-term continuing resolution to fund federal operations. In 2025, the root causes were deeply political. The Republican Party controlled the White House and both chambers of Congress. Yet internal disagreements within the Republican caucus and confrontations with Democrats over policy priorities including extensions of Affordable Care Act subsidies and other safety-net funding blocked agreement.

Because neither party was able to command the votes needed to pass a budget before the deadline, funding lapsed, and the shutdown began. Critics on both sides argued over who was obstructing compromise, but the institutional fact remained: the party that controls the budget process at a given deadline bears heavy responsibility for averting a shutdown.

What Voters Think: Blame, Partisanship, and Public Opinion.

Public opinion during the shutdown reflected deep partisan divides. Polling during the impasse consistently showed that:

- A plurality of voters blamed Republican leaders, including the president and Congressional Republicans, for failing to reach a funding deal.

- Many voters also held Democrats responsible, especially those who insisted on policy conditions attached to funding measures.

- Independents tended to distribute blame more evenly or express frustration with both parties.

These patterns aligned with broader distrust in government: most Americans view shutdowns as a sign of dysfunction and prefer that legislators resolve differences without interrupting essential services.

While precise numbers varied by survey, consistent themes emerged: Republican leadership bore greater public responsibility (especially among independent voters), while partisans defended their own side’s role. This public sentiment was seen as a political risk heading into the 2026 midterms.

Human Impacts: From Federal Workers to Low-Income Families

Beyond politics, the shutdown had tangible human consequences. Government shutdowns disrupt services and benefit that millions rely on for daily survival. The 2025 shutdown was no exception, and in several respects, it went further than many of its predecessors.

Hundreds of thousands of federal employees faced furloughs or continued work without timely pay. Estimates from similar shutdown scenarios suggest that:

- More than 1.9 million federal civilian employees face furloughs or delayed pay in a typical extended shutdown.

- Those working without pay include air-traffic controllers, border agents, and TSA officers critical public safety workers.

- Furloughed workers often suffer immediate income loss and face challenges meeting rent, mortgage, and daily living expenses.

According to delayed government data, the U.S. labor market lost 105,000 jobs in October 2025, largely due to federal positions shedding payrolls amid funding uncertainty, and unemployment ticked up to 4.6%, a four-year high.

Safety-Net Programs: SNAP (Food Stamps), WIC, and Food Security

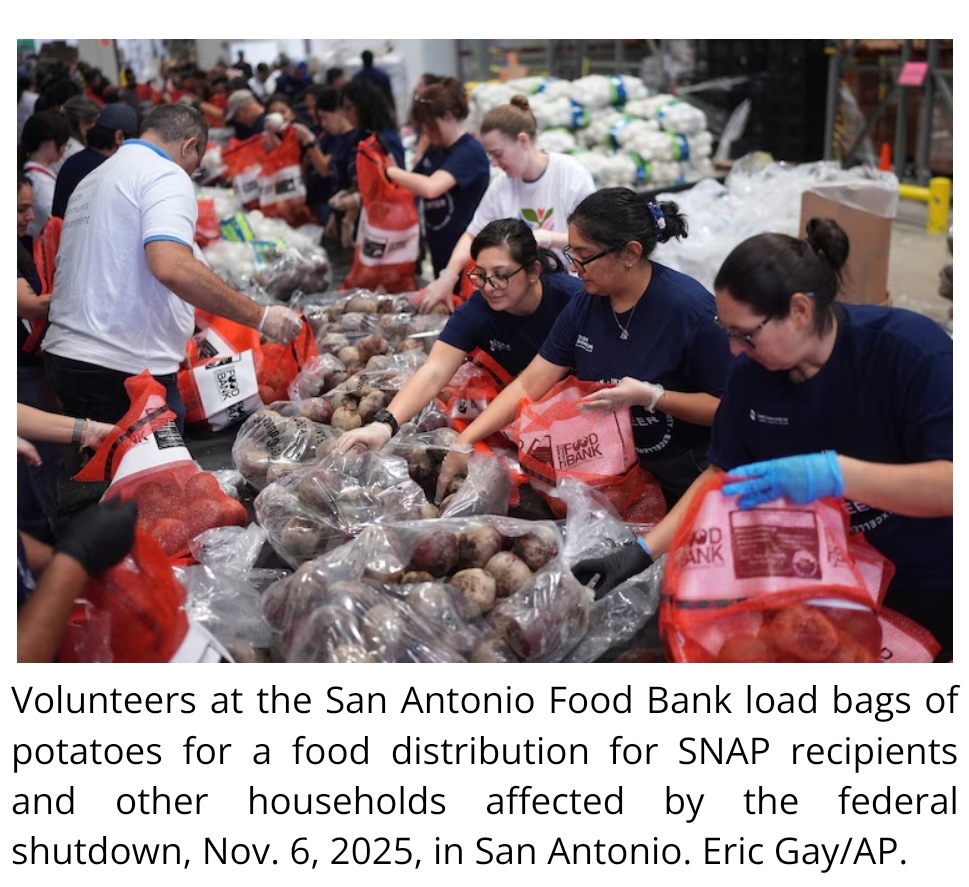

Perhaps the most striking impact of the 2025 shutdown was on America’s social safety net. The Supplemental Nutrition Assistance Program (SNAP) serves roughly 41 million Americans, roughly one in eight, providing essential grocery purchasing support. During the shutdown:

- Payments were delayed and then temporarily reduced, creating unprecedented uncertainty for recipients.

- The USDA’s contingency fund could cover only a fraction of monthly benefits, leaving states scrambling to fill gaps.

One of the most persistent misconceptions in American political discourse is that reliance on food assistance programs like the Supplemental Nutrition Assistance Program, SNAP, is rare, static, or confined to a narrow segment of society. In reality, SNAP participation is widespread, fluid, and deeply tied to the economic volatility faced by millions of households across all races and regions. Government shutdowns do not simply disrupt abstract systems; they interrupt a fragile support structure that many Americans move in and out of as their financial circumstances change.

As of 2025, SNAP serves approximately 42 million people each month, nearly one in eight Americans. These benefits are modest, averaging about $190 per person per month, but they often make the difference between food security and hunger. For families living paycheck to paycheck, even a brief delay in benefits can trigger immediate hardship.

SNAP is not a permanent condition for most recipients. It is a temporary stabilizer, designed to help households weather periods of income loss, reduced work hours, medical emergencies, or other economic shocks.

Federal research shows that about half of all SNAP participants remain enrolled for fewer than ten months. Roughly 38% leave the program within six months, and nearly 58% exit within one year. This constant movement, known as program churn, reflects the unstable nature of low-wage work and the thin margin separating many working families from poverty.

This churn cuts across racial and geographic lines. Workers in retail, hospitality, caregiving, construction, and logistics often experience fluctuating hours or seasonal layoffs. A small raise, temporary overtime, or short-term contract can push a household above SNAP eligibility thresholds, only for a later income dip to force re-enrollment. The result is a cycle in which SNAP functions less as a static welfare program and more as an emergency shock absorber for the American labor market.

When a government shutdown interrupts or threatens this system, it destabilizes households already living close to the edge. For people cycling in and out of SNAP, uncertainty about whether benefits will arrive can immediately affect grocery purchases, rent decisions, and medical spending.

SNAP serves Americans of every race, but longstanding economic inequalities shape who relies on the program and how often. In absolute numbers, White Americans make up the largest share of SNAP recipients, accounting for roughly 35 to 37%, or about 15 million people. This reflects population size rather than disproportionate reliance.

At the same time, Black Americans, who make up about 12.6% of the U.S. population, represent roughly 25 to 26% of SNAP participants, or more than 10 million people. Hispanic or Latino households account for approximately 15 to 16%, while Asian Americans represent 3 to 4%, and Native American and Alaska Native households account for about 2% of recipients.

These disparities are not driven by higher dependency, but by structural differences in income, employment stability, wealth accumulation, and exposure to economic shocks. Communities of color are more likely to experience job volatility, lower wages, and fewer financial buffers, making temporary reliance on SNAP more common.

Importantly, SNAP participation is especially high among children. Nearly 40% of recipients are under the age of 18, meaning that disruptions in benefits directly affect childhood nutrition, development, and long-term health outcomes. Older adults and people with disabilities account for more than one-fifth of participants, groups for whom food insecurity carries heightened medical risks.

During a government shutdown, SNAP is funded through a combination of mandatory appropriations and contingency reserves. While benefits do not immediately stop, extended shutdowns strain those reserves, creating delays, administrative bottlenecks, and uncertainty at the state level. States may issue partial benefits, delay issuance dates, or rely on emergency funding mechanisms that are not designed to last, and in the case of the last shutdown, many states hesitated due to political alliances.

There is also the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), which is critical for young children and pregnant women and serves more than 6.8 million people. During the shutdown, funding models were strained, with some programs relying on limited state resources until federal funding resumed.

Broader Economic and Social Costs

Shutdowns also disrupt broader economic activity:

- Economists estimate that prolonged funding lapses can shave growth from GDP in the short term, reflecting lost consumption and investment.

- Small businesses reliant on government contracts or consumer spending from federal employees may suffer revenue losses.

- Delays in loan programs, permits, and regulatory oversight add to uncertainty for households and firms alike.

Anecdotal reports during the 2025 shutdown described long lines at food pantries, delayed social services, and federal contract freezes, illustrating cascading effects beyond direct government payrolls.

Conclusion

The 2025 government shutdown was a dramatic demonstration of political fragmentation and the human cost of legislative failure. While both major parties engaged in negotiations, public opinion consistently suggested that Republican leadership controlling both the presidency and Congress bore a larger share of the responsibility for the impasse. The shutdown’s material impacts on federal workers, on low-income family’s dependent on SNAP and WIC, and on broader economic confidence tell a deeply concerning story on how political standoffs translate into household hardship.

As the nation moves past this historic shutdown, policymakers face nearly universal pressure to reform budget processes, protect essential services, and ensure that future fiscal disagreements do not carry such high costs for the most vulnerable.